Back

11 Sep 2018

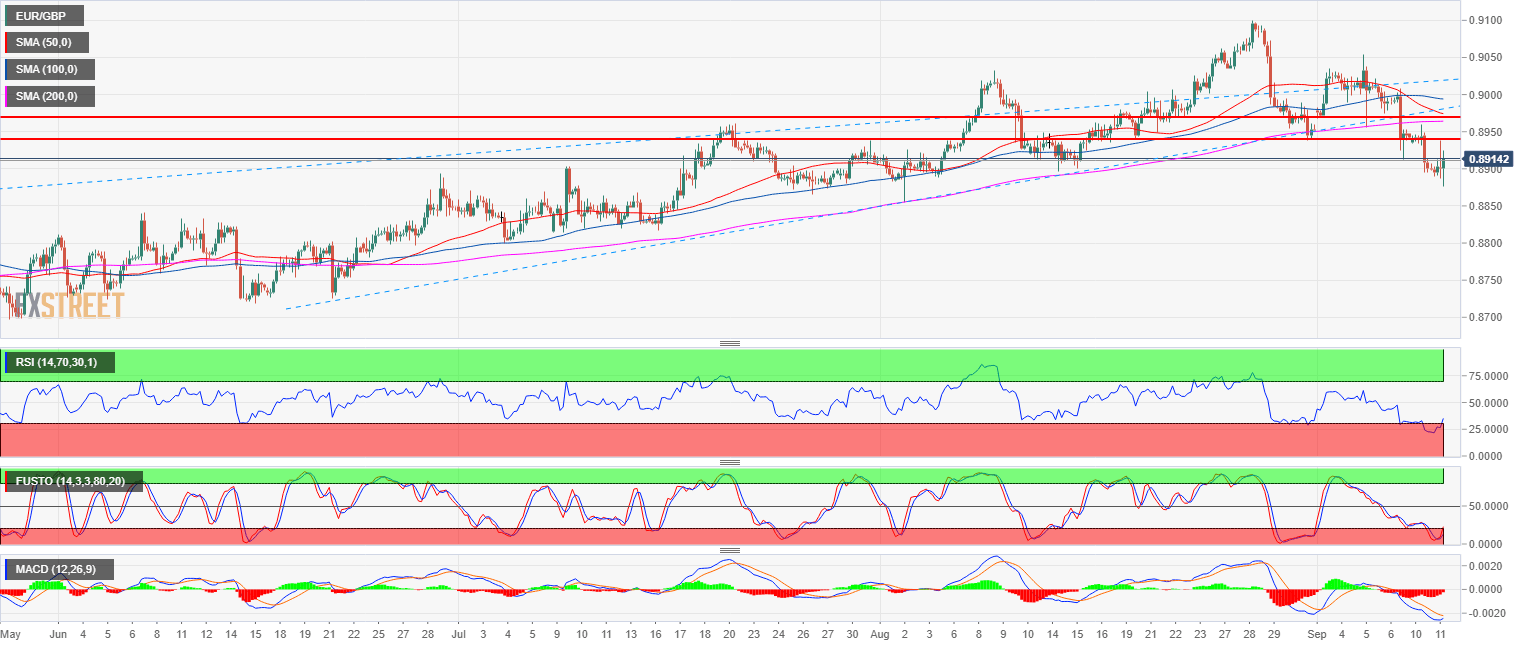

EUR/GBP Technical Analysis: Bulls in charge above 0.8900 figure

- EUR/GBP bulls are trying to maintain the main bull trend as they are attempting to support the market above the 0.8900 figure.

- EUR/GBP is trading below its 50, 100 and 200-period simple moving averages on the 4-hour chart suggesting a bearish bias.

- However, the market is losing bearish momentum as the RSI, Stochastics and MACD are turning bullish from extreme oversold conditions. Short-term bullish targets can be located near 0.8940 August 14 high and 0.8974 (September 6 low). The targets can potentially become new short entry location.

EUR/GBP 4-hour chart

Spot rate: 0.8914

Relative change: 0.16%

High: 0.8938

Low: 0.8876

Main Trend: Bullish

Short-term trend: Bearish

Resistance 1: 0.8940 August 14 high

Resistance 2: 0.8974 September 6 low

Resistance 3: 0.9000 figure

Support 1: 0.8896 August 14 swing low

Support 2: 0.8864, July 26 low

Support 3: 0.8840 supply level