EUR/NOK flirting with highs near 9.8500

- The cross moves to multi-week tops near 9.8500.

- Norway CPI surprised to the downside in January.

- Sell-off in Brent crude weighs on NOK.

The Norwegian currency is extending the downbeat mood at the beginning of the week and is helping EUR/NOK to advance to new multi-week highs near the 9.8500 handle.

EUR/NOK up post-CPI, looks to Brent

NOK has accelerated the downside today and pushed the cross to fresh tops after inflation figures in the Scandinavian economy disappointing prior surveys for the month of January.

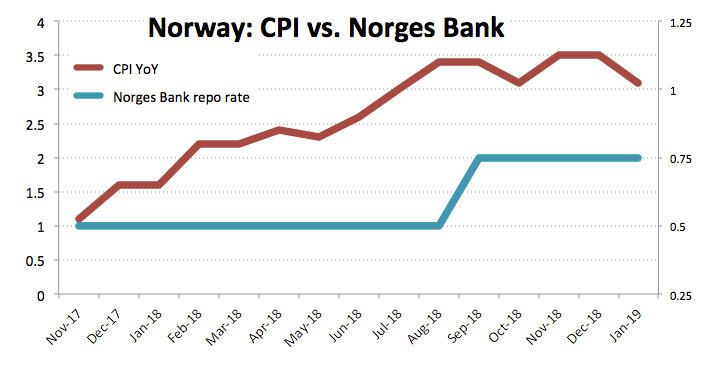

In fact, consumer prices gauged by the CPI contracted 0.5% inter-month and rose 3.1% from a year earlier. In addition, Core CPI YTD rose 2.1% and monthly Core Inflation dropped 0.7%. further data saw Producer Prices advancing 4.9% over the last twelve months from December’s 7.7% gain.

In the same line, prices of the European reference Brent crude are prolonging the sideline theme around the $62.00 mark so far today, while the sentiment in the risk-associated universe remains somewhat deteriorated, all impacting on NOK.

What to look for around NOK

The mood around the risk complex and Brent-dynamics continue to be the main drivers for the Norwegian currency for the time being. In the broader picture, fundamentals in the Nordic economy remain strong and the Norges Bank is set to hike rates twice this year, with the next raise likely to be in March. This view has been reinforced by the December Regional Network Survey, which stressed the growth outlook for the economy remains strong. In addition, the first quarter is usually NOK-positive reinforced by tighter conditions in structural liquidity.

EUR/NOK significant levels

As of writing the cross is gaining 0.45% at 9.8152 and a break above 9.8386 (high Feb.11) would aim for 9.9937 (2017 high Dec.21) and finally 10.0572 (2018 high Dec.27). On the flip side, the next down barrier emerges at 9.7679 (55-day SMA) seconded by 9.7226 (21-day SMA) and then 9.6424 (2019 low Feb.1).