USD/CNH Price Analysis: Bulls firming the grip on China data, PBOC’s inaction

- USD/CNH fails to extend the previous day’s losses, aims for multi-day-old resistance line.

- China’s Retail Sales, Fixed Asset Investment came in below forecast, PBOC refrained from MLF rate cut.

- A confluence of monthly support line, 21-day EMA restricts immediate downside.

USD/CNH prints mild gains of near 0.10% while taking the bids to 7.1162 ahead of the European session on Friday.

The pair recently benefited from downbeat prints of China’s April month Retail Sales and Fixed Asset Investment while also responding to the People’s Bank of China’s (PBOC) no rate change at 2.95%.

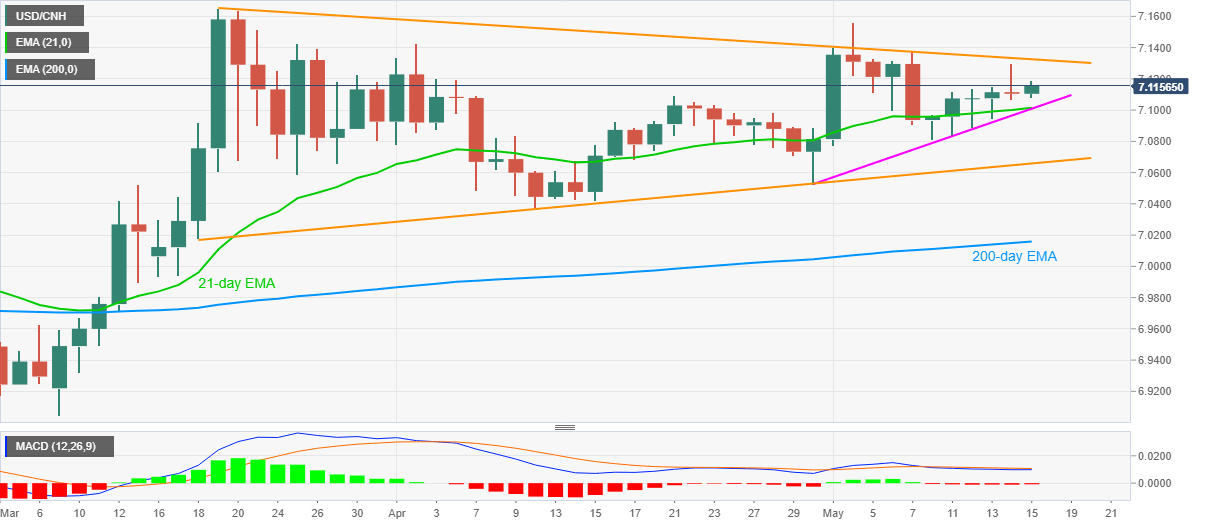

That said, the quote currently rises towards a falling trend line from March 19, around 7.1325, a break of which could escalate the run-up to the monthly top near 7.1563.

During the pair’s extended rise beyond 7.1563, March 19 high near 7.1654 will be on the bull’s radar.

On the flip side, a confluence of the monthly support line and 21-day EMA restricts the pair’s immediate declines near 1.1010/15, a break of which could drag it to the triangle support near 7.0660/55.

If at all the bears dominate past-7.0655, a 200-day EMA level of 7.0160 could flash on their radars.

USD/CNH daily chart

Trend: Further recovery expected