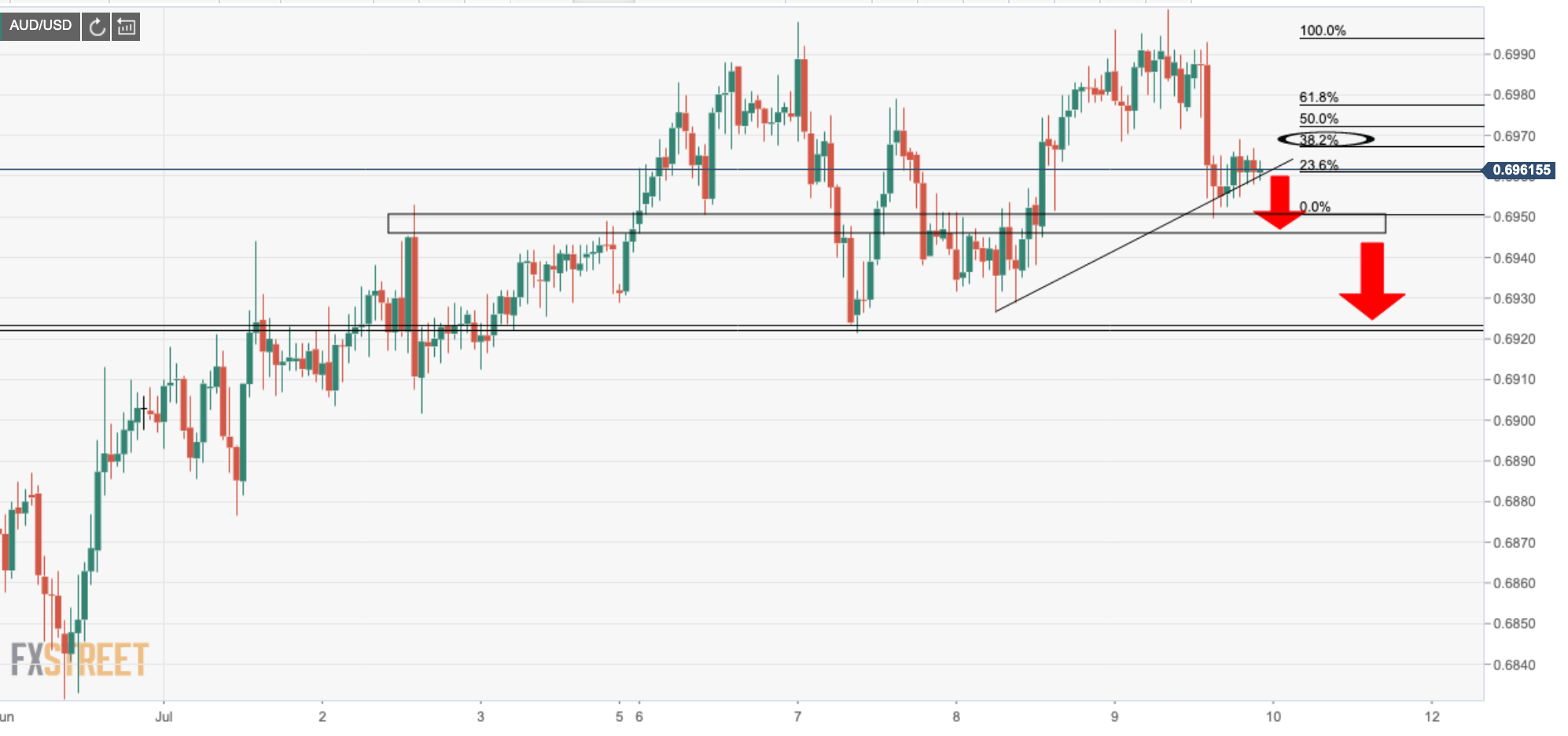

AUD/USD: bears lined-up for breakout below trendline support

- AUD/USD is testing the bull's commitments at trendline support.

- 38.2% Fib capping upside attempts as US dollar picks up a bid in risk-off conditions.

AUD/USD is currently trading at 0.6961 between a range of 0.6958 and 0.6964 as bears chip away at the hourly trendline support below 0.7000.

The pair lost its footing since yesterday's trade, succumbing to the coronavirus risk-off themes throughout the session overnight.

Here in Asia on Friday, bears will be keen to see a break and retest of the support line before committing to shorts below it ahead of the weekend.

As for data from overnight, the Initial claims were better than expected, falling 99k in the week ended 4 July to 1.314k vs expectations of 1.375k.

Encouragingly, continuing claims fell 700k to 18.06m suggesting return to work is continuing despite the recent rise in COVID-19 cases,

analysts at ANZ Bank explained.

Meanwhile, last week, the Australian Government announced a near AUD75bn upgrade to the defence budget over the coming decade. "The bottom line is that, as well as being an important statement on the geostrategic environment, there is conservatively AUD190bn of Defence business up for grabs between now and 2029-30," analysts at ANZ Bank explained.

Geopolitics is definitely a driver of the Aussie and trade war risk is never too far from the radar.

As for commodities, we have seen a slump in global oil prices and gold was unable to hold on to the 1800 levels with much conviction. copper prices also took a turn for the worst which have all sewed the seeds for the Aussie bears.

The day ahead

The calendar is quiet until New York's session where we will see US Retail Sales, so the prospects are purely technical moves and headlines pertaining to the spread of the virus.

For the day ahead, bulls will look for sturdy equity prices, but further tests of support likely and sustain breakout opens risk to 0.6940 and 0.6897 38.2% and 61.8% respective Fib retracements. Eyes will also remain on copper prices as gains erode while yen and greenback are bought, weighing on the near-term outlook.

AUD/USD trendline support pressured