EUR/JPY Price Analysis: Bulls again step back from 122.00

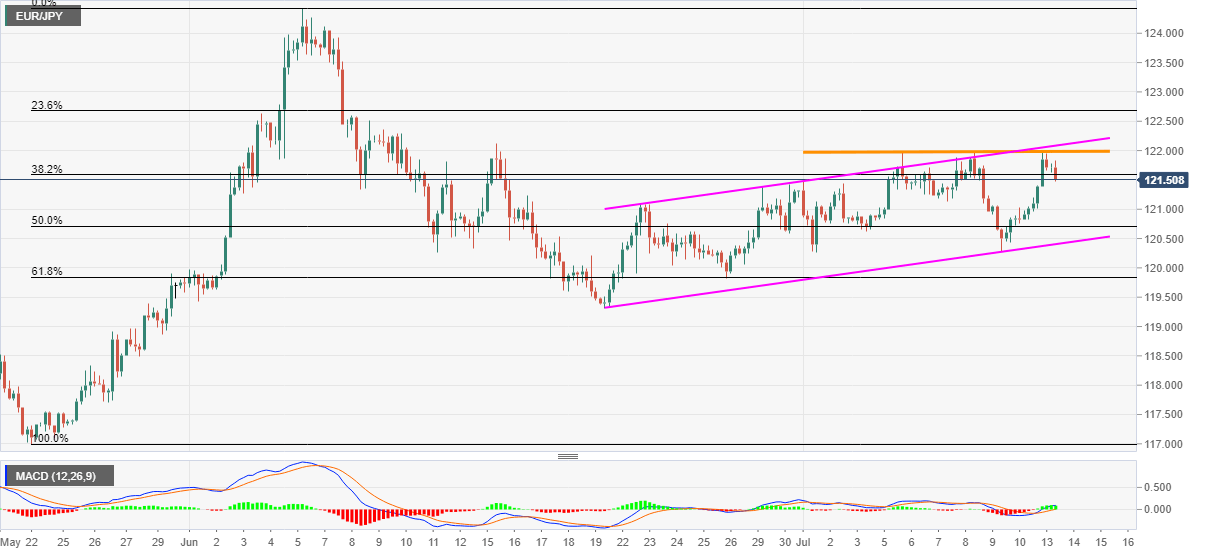

- EUR/JPY portrays another pullback from 121.97 inside a three-week-old ascending trend channel.

- The key Fibonacci retracement levels will add filters to the downside, the channel’s resistance becomes extra upside barrier.

- Bullish MACD, rising channel keep the buyers hopeful.

EUR/JPY declines to 121.48, down 0.20% on a day, during the early Tuesday. In doing so, the pair registers third failure to cross the 122.00 thresholds while staying inside a short-term upward sloping trend channel formation.

Considering the pair’s repeated weakness from 121.97, sellers may aim for a 50% Fibonacci retracement level of May 2 to June 05 upside, at 120.71, as the immediate target. Though, the mentioned channel’s support line, currently around 120.40, will question the bears afterward.

If at all the EUR/JPY prices defy the bullish chart pattern, 61.8% Fibonacci retracement level of 119.84, will offer additional downside support to validate the pair’s further weakness.

Meanwhile, an upside clearance of 122.00 will need validation from the mentioned channel’s resistance, at 122.10 now, a break of which could attack 122.50 and 123.00 numbers to the north.

It should, however, be noted that the bulls’ ability to conquer 123.00 will challenge June month’s top of 124.43.

EUR/JPY four-hour chart

Trend: Pullback expected