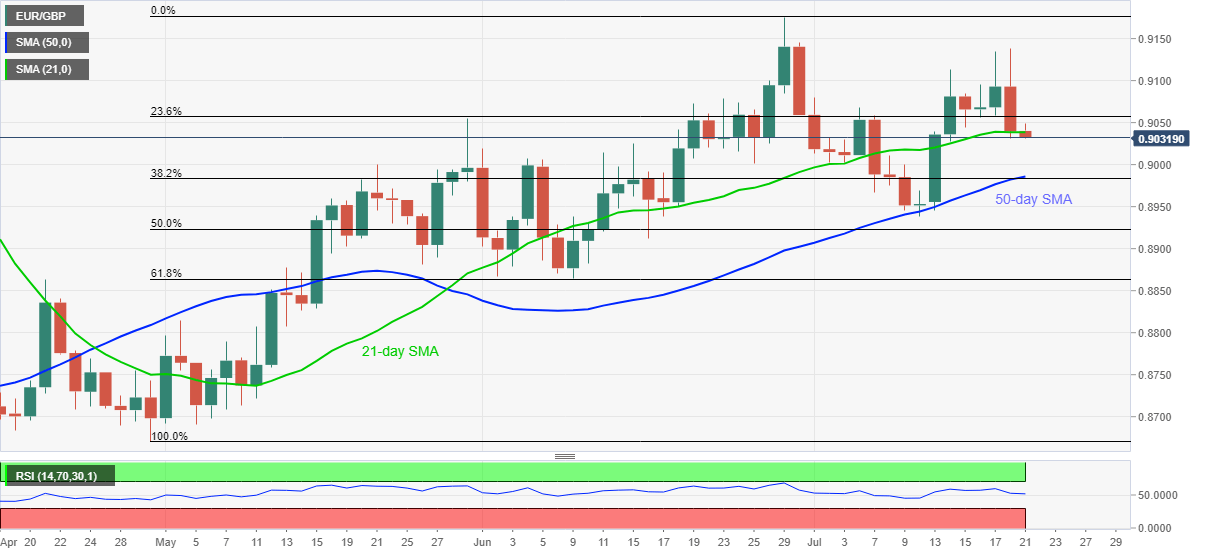

EUR/GBP Price Analysis: Breaks 21-day SMA after EU summit’s welcome deal

- EUR/GBP extends losses from 0.9049 to attack weekly low.

- European policymakers agreed for 750 billion Euros of stimulus after five days of tough negotiations.

- The pair needs to close below 21-day SMA to aim for 0.8990/85 support confluence.

- The 0.9100 threshold acts as immediate upside barrier.

EUR/GBP stays depressed around 0.9035 during the pre-European trading on Tuesday. The pair seems to have offered a little reaction to the European leaders’ agreement over the much-awaited stimulus package. The reason could be traced from the quote’s inability to justify a 21-day SMA breakdown.

Read: Breaking: EU leaders reach deal on post-pandemic recovery package for economy

Sellers are waiting for a clear downside break below 0.9030 to aim for 0.9000 psychological magnet. However, a joint of 50-day SMA and 38.2% Fibonacci retracement of April-June upside, near 0.8990/85 becomes the tough nut to crack for the bears.

In a case where the sellers keep dominating past-0.8985, the monthly bottom of 0.8938 and 0.8900 round-figures could return to the charts.

Meanwhile, any upside past-0.9100 will recall the bulls targeting to refresh the monthly top near 0.9140. In doing so, June month’s peak near 0.9175 and 0.9200 could become their favorites.

EUR/GBP daily chart

Trend: Pullback expected