Back

22 Jul 2020

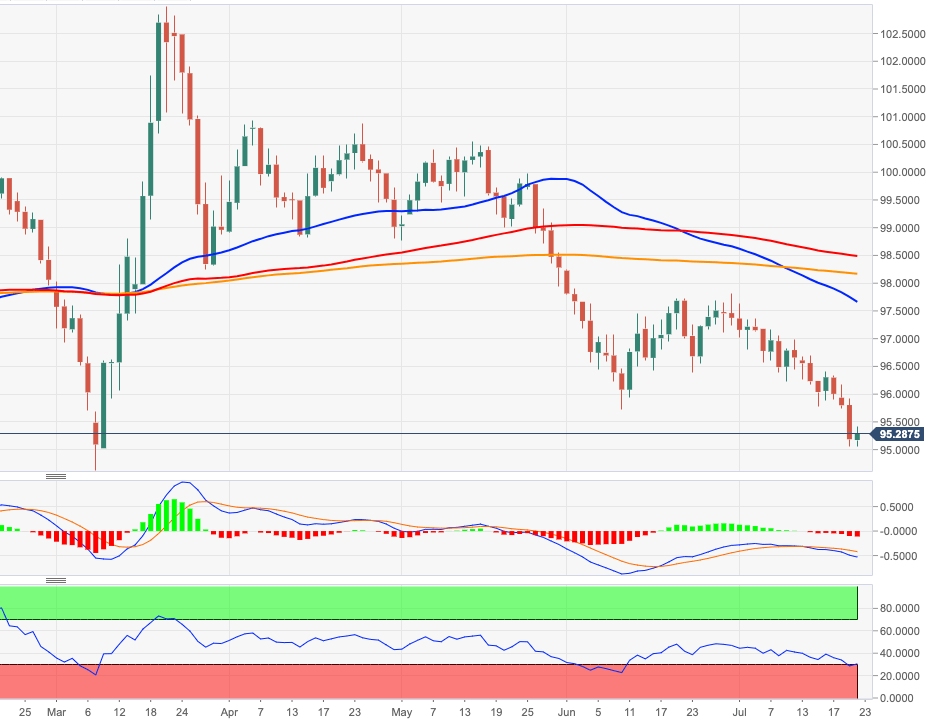

US Dollar Index Price Analysis: A drop to 94.60 remains on the cards

- DXY appears to have met some contention near the 95.00 mark.

- A deeper pullback exposes the YTD lows in the 94.65/60 band.

The sell-off in DXY has reached fresh 4-month lows in the 95.00 neighbourhood so far this week.

Extra losses in the current context are increasingly likely, leaving the door wide open for a probable move and test of the yearly lows near 94.60 recorded in early March.

The negative outlook on the dollar is expected to remain unaltered while below the 200-day SMA, today at 98.16.

DXY daily chart