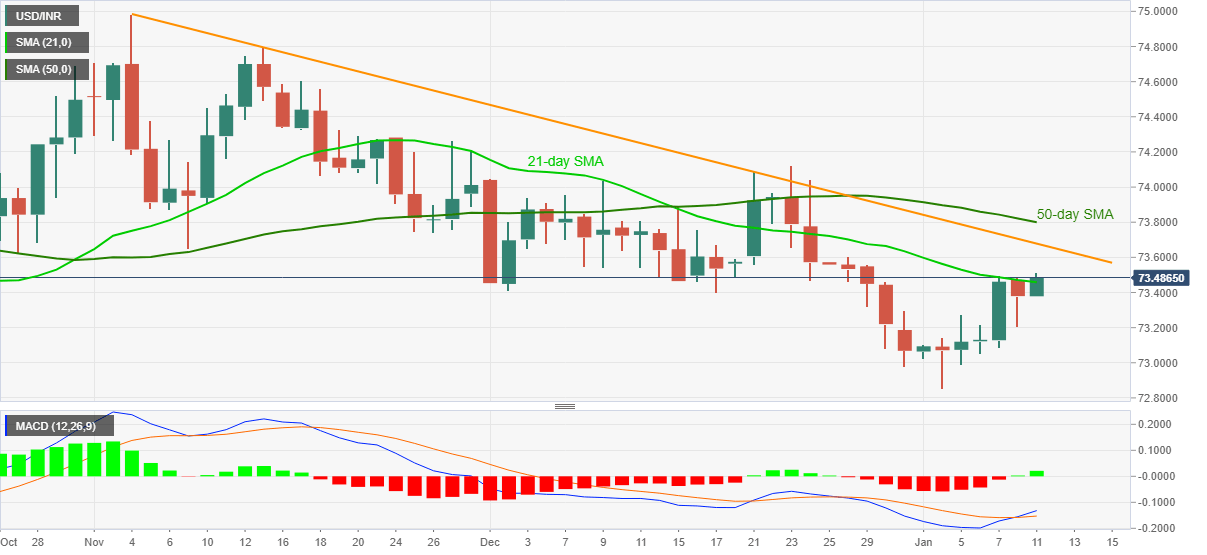

USD/INR Price News: Indian rupee sellers pierce 21-day SMA amid most bullish MACD in 13 days

- USD/INR refreshes two week high as it crosses 21-day SMA.

- MACD conditions, successful bounce off 73.00 favor bulls.

USD/INR takes the bids near the intraday high of 73.51, up 0.16% on a day, ahead of Monday’s European session. In doing so, the Indian rupee pair jumps past-21-day SMA while rising to the highest since December 29.

Not only an upside break of immediate Simple Moving Average (SMA) but MACD conditions also favor USD/INR buyers. The MACD rises to the strongest levels since December 23 by press time.

As a result, USD/INR bulls eye a falling trend line from November 04, at 73.67 now, before targeting a 50-day SMA level of 73.80.

It should be noted that the 74.00 round-figures and December’s peak around 74.12 will lure the pair buyers beyond 50-day SMA.

Alternatively, a failure to keep a 21-day SMA breakout will recall a 73.30 level on the chart. Though, USD/INR sellers will wait for a clear downside break of the 73.00 threshold for fresh entries.

Following that, the monthly low, also the lowest since September 2020, near 72.85, will be in the spotlight.

USD/INR daily chart

Trend: Further upside expected