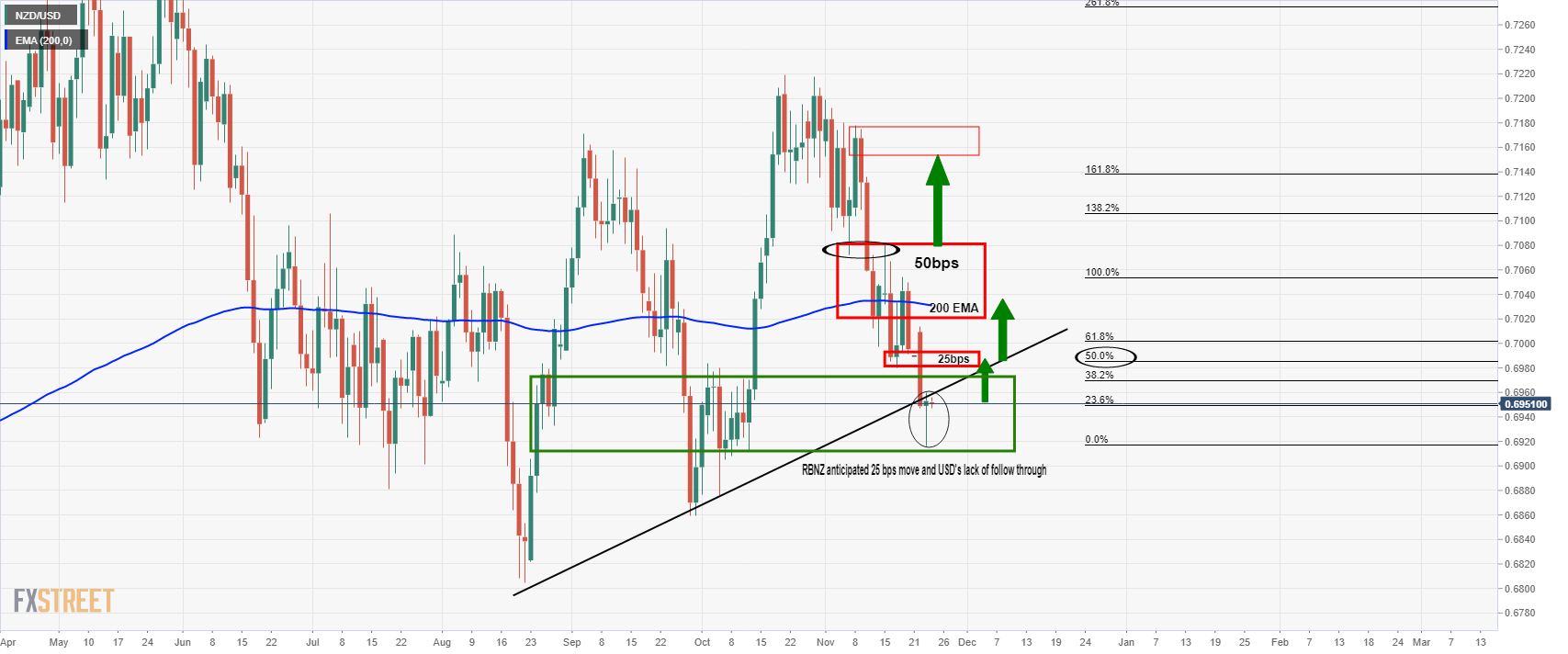

Breaking: RBNZ hikes as expected by 25bps, NZD/USD undecided

The RBNZD has hiked the OCR by 25bps and sees headline inflation above 5% in near-term with the projections showing thecash rate rising to 2% by end of 2022.

More to come...

Before the RBNZ statement

However, in the technical preview, it was started that the downside risks were as follows:

RBNZ dovish outcome

''The risk to the downside comes on a uber hawkish set of Fed minutes coupled with a dovish hike from the RBNZ. A dovish hike could consist of concern over covid contagion, geopolitical risks, the guidance of incremental 25bps hikes, contingent on various factors. All of the above would catch an already heavily long positioning in the kiwi market offside. 0.6950 is a line in the sand in this regard and a break will open risk to a restest of the 0.6880s and then 0.68 the figure.''

After the RBNZ statement

The bird is a touch lower...more to come...