AUD/USD Price Analysis: Traders battle it out near to breakout 0.7180 level

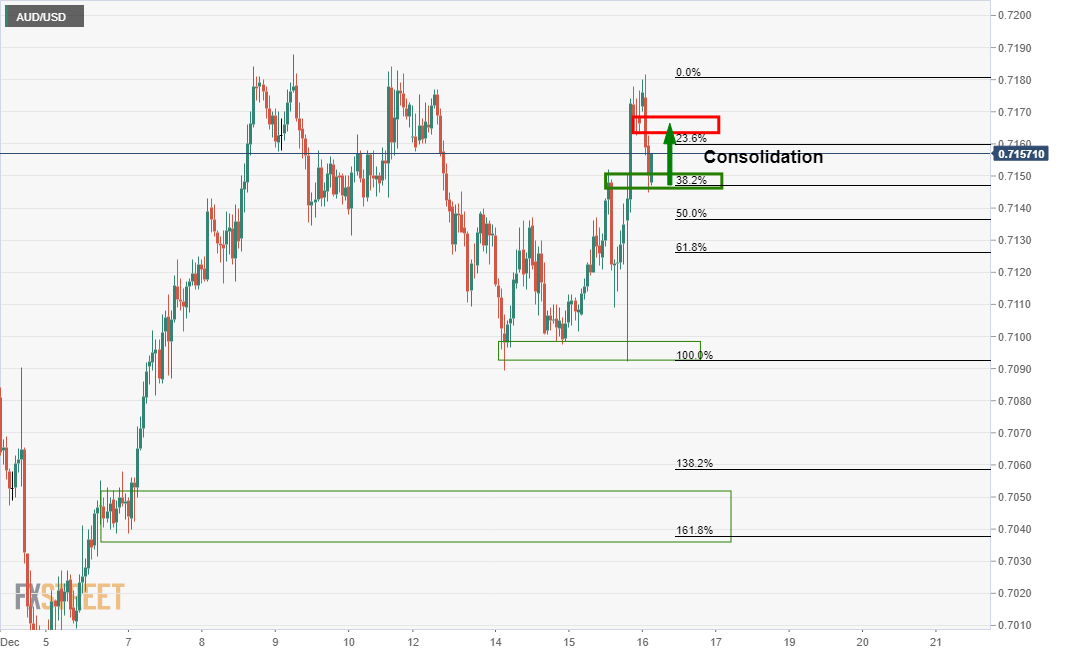

- AUD/USD moves into a phase of consolidation.

- Bulls need a break of 0.7180 and the bears seek a break of 0.71 the figure.

AUD/USD has been changing hands between the bears and bulls throughout the past two sessions on the back of the US Federal Reserve volatility and domestic jobs data in Asia.

This has left the outlook for the pair uncertain with a lack of firm directional tendencies, at least from an hourly perspective as follows:

AUD/USD H1 chart

As illustrated, the price has completed a 38.2% Fibonacci retracement since it was capped following both the Fed and the Aussie jobs report earlier.

Without a catalyst until the European Central Bank, the price would be expected to consolidate at this juncture. 0.7150/70 marks current support and resistance from a short term perspective.

AUD/USD daily chart

0.7180 and 0.7100 are the extremes on the daily chart and key levels where a breakout could occur.

Should the US dollar find its supporters again, then the downside breakout could occur as illustrated above.