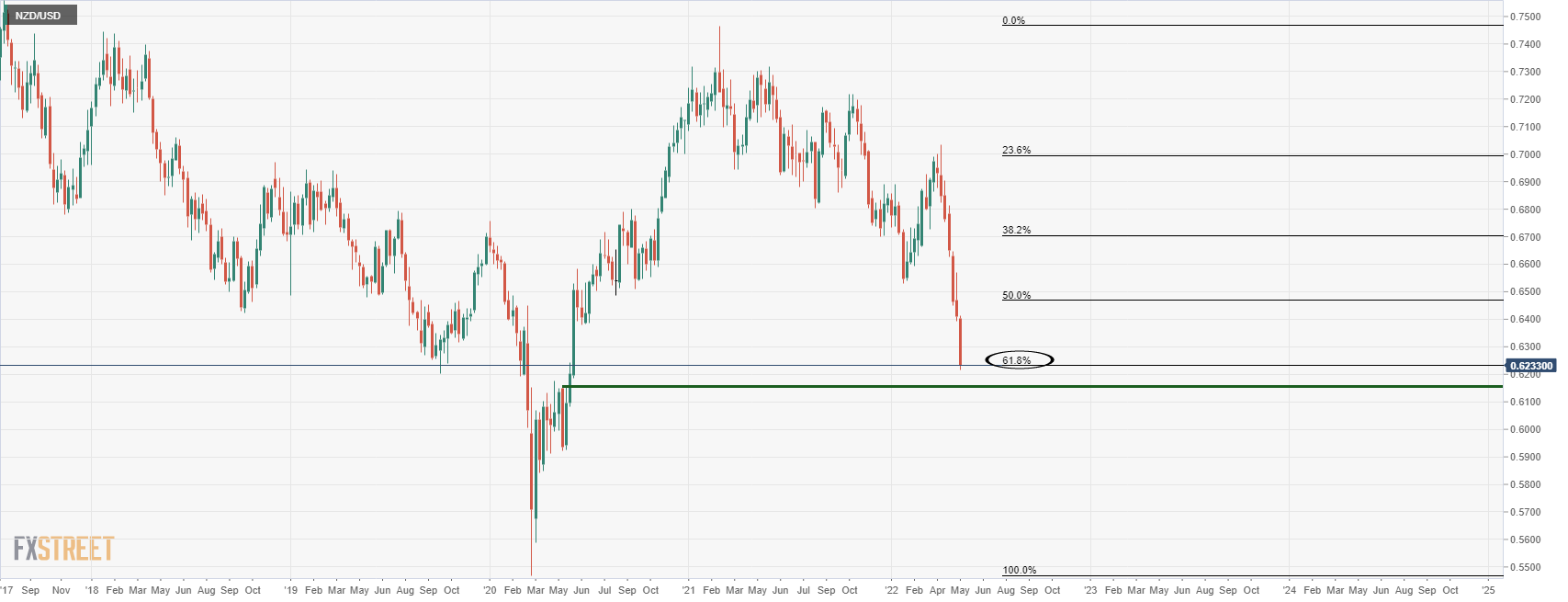

NZD/USD bears move in on a key 61.8% Fibo

- NZD/USD bears take on the 61.8% Fibo of the 2020 rally.

- The US dollar picks up a safe haven bid and US stocks drop, weighing on the high beta currencies.

At 0.6238, NZD/USD is lower by some 0.90% on the day as Wall Street draws to a close. The pair has been in the hands of the bears following a brief correction on Wednesday while the US dollar picks up a safe-haven bid again on Thursday.

The high beta currencies have been pummeled as risk-off sentiment takes hold. Global shares are at their lowest point in 18-months, supporting the greenback to a fresh 20-year-high as investors fear that inflation pushing up interest rates will bring the global economy to a standstill.

''It has been a punishing time for financial assets since the Fed raised rates by 50bps last week and the subsequent strong US jobs market, and CPI data have reinforced concerns over the extent of the task facing the Fed,'' analysts at ANZ Bank said.

''One notable aspect of the turmoil has been lower bond yields, with the US 10yr at ~2.83%, having touched 3.20% on Monday. That signifies that markets think the drama could influence policy. If the ramifications of volatility/tumbling asset prices become that significant, it’s hard to see markets shying away from the USD’s safe-haven appeal any time soon. This morning’s NZD break of 0.6230 (the 61.8% Fibo of the 2020/21 rally off COVID lows) is a negative technical development.''

NZD/USD technical analysis

The price is en route towards a break below 0.62 the figure that guards the late May 2020 highs.